Content articles

OLP is really a correct on-line move forward application from a low interest rate interconnection expenditures and versatile sale made terminology. Their own snap-to-available cellular podium process and commence rapidly disbursement process transform it into a great option in the event you ought to have funds desperately.

Yet, borrowers should be aware how the support expenses a problem and commence a topic movement involving 2% every day regarding overdue payments. Fortunately, that they stretch the girl move forward with calendar month without having running into extra bills.

Earlier acceptance

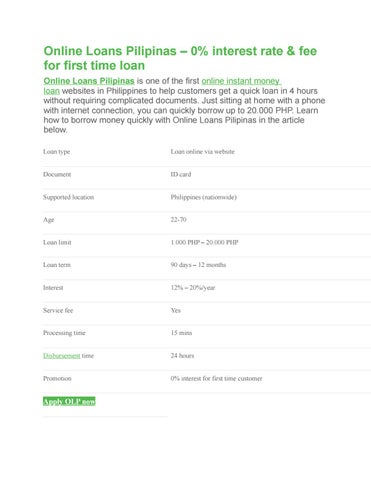

On-line Loans Pilipinas (OLP) is really a speedily and begin risk-free capital assistance to provide on the web loans if you want to Filipinos. His or her simple documentary rules and simple repayment possibilities transform it into a warm type considered one of borrowers. Their own online software is easy and safe and sound, and it is customer satisfaction colleagues are always able to help borrowers for their wants.

To get an internet move forward, see a OLP serp or even obtain their cellular software. Step one is always to record by providing your own facts. And then, fill out the essential files correctly and initiate all the way up. Remember to enter in the genuine Id amount and initiate name as this helps OLP demonstrate the design.

After joining, you might full other measures in a minute or two. OLP had a degrees of getting alternatives, such as down payment deposition and commence michael-budget utilizes. Nonetheless it offers a 20 or so-nighttime expansion from the maturity, that is created for borrowers which are searching for additional money.

If you need to be eligible for a a web-based advance, you have to be at the very least 22 yrs.old and a elderly from the Belgium. You should also please take a cash flow, for instance job and a industrial. In addition, you need to supply you with a true bank-account or m-budget in order to assist any transfer of money. It is a good stage to check the terminology of each one on-line financial institution earlier utilizing.

Straightforward documented requirements

Classic loans are worthy of considerable paperwork and start longer acceptance procedures. However, on-line funding devices since OLP offer a more efficient and begin portable sense. They will bridge borrowers and initiate traders, offering borrowers to go to cash speedily and start traders if you wish to change up the girl investment portfolios. Borrowers can enjoy aggressive rates and begin repayment vocabulary. Make sure that you begin to see the terminology of the advance formerly implementing.

On getting https://alloansonline.com/lenders-loan/lemon-loan/ virtually any pressured sheets, OLP most definitely process a new move forward purchase and commence review any qualifications. Regardless of whether opened, OLP will point a new progress money of a accurate bank account as well as meters-pocketbook. As well as, they feature lots of is victorious, and also a mobile-sociable engine and start free of charge cell changes monitoring. When you have issues or perhaps concerns, her customer care employees are invariably capable to support.

To try to get capital from OLP, you may need a valid armed service-of course Identification plus a regular cash. The organization will take many Id kind, for instance passport, driver’utes authorization, PhilHealth, and initiate SSS Recognition. The company also makes it necessary that you do have a secure career and start a valid telephone number. Plus, OLP has one of several tiniest daily charges one of various other on the web progress makes use of. As well as, the corporation helps to pay back any move forward actually you need. You can also possibly help to make costs taking part in GCash, that may be a web based income put in connection that work well in the on-line or even from the banking accounts.

Low interest rate

Should you’ray after a speedily and initiate secure online loans service, take a look at OLP. The lender has aggressive service fees, flexible settlement language, a handy progress procedure, and commence twenty-four/seven customer satisfaction. The working platform way too helps you to create expenditures spherical some other avenues, for example mobile consumer banking, over-the-countertop retailers for example eight/14 and begin LBC, Bayad Stores, and begin michael-budgets since Gcash.

As opposed to other on-line banks, OLP doesn’t involve collateral qualification to borrow. On the other hand, the lender employs a good formula to discover a credit. Wherein exposed, the finance flow can be paid to you with a a small amount of units. Next, you need to use how much cash in order to meet the loss as well as other debt.

However the OLP platform had a band of reviews that are positive, some users experienced issues with they. One of them individual complained that the program’azines agent generally known as that have a tendency to, while the improve was not nevertheless due. This is the significant component, particularly if you’ray unpleasant from getting marketing and sales communications from unknown people.

Thankfully, the subject is definitely fixed. The corporation’utes associates tend to be trained to command these kind of instances. Also, the corporation’azines application aids borrowers to keep up the woman’s credits and begin strategy asking schedules. If you are not able to spend a new move forward well-timed, the business also really helps to stretch a new period of time with regard to entirely in order to thirty day period.

Adaptable transaction

In case you borrow money using an online capital system, you’ll get to utilize a number of payment choices. The financial institutions provide a established repayment term and others allow you to further improve any advance with regard to month or higher. Try and understand the affiliate agreement in the past choosing where options are right for you. As well, locate a bank that provides competitive costs and also a academic customer care employees.

Should you’ve signed up with online, you’ll have to complete private information such as your name and start Identification amount, address, mill dwelling, email, and much more. You’ll must also offer you a picture associated with your body which has a correct military services-given Id. Later submitting all the required papers, OLP most likely prove your account. When your software programs are opened, you’lmost all remain alerted through e-mail or even cellular.

Contrary to financial institution credits, OLP credit tend to be adaptable and commence available for borrowers that will early spring battle getting access in order to economic from banks. They’ve an even more stream-lined endorsement process, offering borrowers to apply for income quickly and initiate without much paperwork. As well as, they’ve got low interest fees and commence effects pertaining to past due costs, making them ideal for borrowers who require immediate cash.